IFC (International Finance Corporation)’s 19th Annual Global Private Equity Conference in association with EMPEA (Emerging Markets Private Equity Association) took place on the 15-17 May at Ritz-Carlton, Washington, DC. The Conference convened with over 800 PE professionals including 300 LPs, from more than 60 countries.

Turkey Panel:

As well as all the important panels, this year for the first time since 2012, the Turkey session was organized. EMPEA Turkey Representative and Globalturk Capital’s Founder and Managing Partner Barış Öney has moderated the panel. Representatives of ISPAT (Investment Support and Promotion Agency of Turkey), İş Private Equity, Turkven and Türkiye Wealth Fund was in the Turkey Session. Panelists clarified many issues related to the investments and exits in Turkey. Important topics discussed by the panelists were;

- Recent Fund Raisings reached close to $1 billion over the last one year. Abraaj, Mediterra, Taxim and Revo raised money from DFI’s and private sources both from foreign institutions and local family groups.

- This is expected to continue now that the referendum is over and no elections are foreseen till November 2019, where the new Presidential System will get into effect.

- Local family groups have learned the asset class quite well and started to feel comfortable investing in, which is expected to continue.

- Again in the last one year solid exits happened which totalled over $1,5 billion. Mars Cinema Group sold to Koreans by Actera, Digiturk sold to Qataris by Providence Capital and Logo sold to foreign institutional investors in the Stock Market by Mediterra seeing 5x returns in EUR terms were the highlights of the exits.

- South-south exits also happened where two Indian companies bought shares from private equity investors like Darby. ADM Capital’s exit from Cevher was also significant.

- Soon after new fund raisings, Taxim, Mediterra and Abraaj made a number of investments, where Actera made a significant investment from its previous fund.

- PE activity is strong on the ground both in terms of investments and exits.

- Turkey’s companies, large groups to mid-size ones started looking for outbound acquisitions which could further bring more opportunities for the private equity funds to invest on these growth projects.

- The Government also now understands and promotes private equity asset class and looks positive to such investments.

- Consumer, health care and ICT are the most invested stories where niche and export oriented manufacturing is also getting attention especially to balance the fx risk.

- Türkiye Wealth Fund (TWF) established in August 2016 to help grow the economy and support efficient utilization and leverage of public assets. TWF Management Co. is a joint stock company incorporated under Turkish Commercial Code.

- TWF’s mandate is to manage assets on commercial basis in compliance with professional governance principles, deliver sustainable economic and social value over the long term, no limits for asset class, country or sector, full flexibility to determine portfolio weight.

- TWF plans to invest primarily into technology, Fintech, logistics, infrastructure and energy.

Some important highlights from the Conference are as follows;

The LP SUMMIT

Philippe Le Houerou, CEO, IFC

- A lot is going on in the Middle East. Many young entrepreneurs emerging. Governments need to encourage the entrepreneurial environment to flourish.

- Also the financial infrastructure need to be improved. Banks are not lending to entrepreneurs much. So we need to be active as IFC.

- There is no universal development model for all countries. Every country is different. What worked in China or Asia, may not work in MENA for example.

- In Asia it was manufacturing but may be in the Middle East it is services. So it needs to be studied. And our institutions should be careful when considering such models.

- Also at IFC we are rethinking about the strategy of development financing.

- We are bringing in more private capital both from international and local resources to crowd in private capital. We are trying to create new markets and new opportunities for the private money.

- We are trying to crowd in the insurance companies now for example. Same way we used to do it with banks. We are asking them to invest in the portfolio of IFC. Mostly for the infrastructure projects. We do the first closes and then bring them in to de-risk as much as possible.

- The way to go should be: to create legislations and regulations, invest in education, allow private sector to move in and the rest will follow.

Jeff Schlapinski, Director of Research, EMPEA

Key Highlights of the Recent LP Survey:

- India is the top market to invest in the next 12 months

- Southeast Asia ranks the second.

- Turkey raised 850 million USD last year despite its ranking as the last position of being the 10th.

- Private credit and venture investing is getting more attention than private equity in emerging markets.

- Still most of the funds raised are going to China and India.

- LPs are planning to form fewer relationships with the GPs.

- 52% of LPs plan to increase co-investments and a similar situation is there for direct investing.

- Largest and most established firms have the chance of raising money rather than first time funds.

- Lots of investments but not many exits.

- Most concerns are fx volatility, exits and fundamentals.

- Emerging markets private capital has more returns than public markets, Luis O’Shea, Applied Research at Burgiss.

Key Highlights from Maria Kozloski, Global Head and Chief Investment Officer of Private Equity Funds, IFC and from the following Panel:

- IFC invests $12 billion a year in emerging markets. 80% debt 20% equity.

- Want to support quality local players.

- Promote the development of the asset class in emerging markets.

- Mostly growth capital.

- 290 funds of 56% in growth capital, 6% venture capital 13% infrastructure.

- Much of the capital is going to Asia. 1600 active portfolio companies. 716 companies exited to date.

- Venture capital is growing. Silicon Valley is getting more interested in investing in emerging markets. More talented fund managers are emerging.

Panel: Business and Sustainable Development Commission Discussion

What happens by 2030?

Need $12 trillion minimum to 4 verticals and 60 market segments. We only have 160 months this left to accomplish this and the PE industry could make this happen.

Need to attract best talent to begin with.

Why 4 verticals: Because it covers a large chunk of the GDP. One example is health and education.

UN’s position is to globalize the world with a human face. Started by Kofi Annan. Need to apply human aspect when conducting new businesses and investments. This idea/objective has come a long ways.

New goals are strategically important for businesses to implement. 87% of the CEOs verified that they plan to apply these goals when conducting business in a recent survey.

We are seeing a big shift towards these principles when conducting business and investing.

What are some practical things to do for sustainable development?

– Improve banking regulations to be smarter. -Need to think differently.

– ESG guidelines should be readily available at no cost. Planning a boot camp on these matters would help.

– Need to use some state money and incentives to act as a catalyst to bring in private capital.

We need to measure progress as an important part of this program. It is being worked on right now to be published in September. PRI is being worked to also make sense for the investment community.

Time horizon can be shortened by using more technology. And also need to partner with different groups and financiers to move things forward.

President Recep Tayyip Erdoğan Came Together with the top Private Equity Community Representatives and US Corporates at an Executive Meeting

Investment Support & Promotion Agency of Turkey (ISPAT) held an executive meeting with Turkey President and 40 top US and Emerging Markets Private Equity Investors and Corporates in Washington DC. Barış Öney, Founder and Managing Partner of Globalturk Capital and Turkey Representative of SEAF and EMPEA has attended the meeting.

Turkey and investment opportunities were discussed at the meeting. Company representatives received the answers from the President about the questions they wonder about Turkey.

EMPEA HIGHLIGHTS

GPEC 2017 Day 1 in Review: The Future of Emerging Markets Investing

Globalization Under Scrutiny

The opening panel at the IFC’s 19th Annual Global Private Equity Conference, held in association with EMPEA, recognized the disparity between popular opinion and underlying trends. As Vali Nasr, Dean of the Paul H. Nitze School of Advanced International Studies at Johns Hopkins University remarked, you cannot rely on one to predict the other. Mr. Nasr suggests that the populist challenge to globalization in the developed markets is widespread and that the concept of globalization equaling prosperity cannot always be counted on. Heidi Crebo-Rediker, CEO of International Capital Strategies, voiced her disappointment in policymakers’ inability, in both developed and developing countries, to adjust policy to account for the ‘losers’ of globalization, advancements in technology and job placement. Furthermore, she acknowledged that it will become increasingly difficult to make investments in people that complement technological changes, given the challenges that artificial intelligence and automation will pose to emerging markets’ way forward.

Mr. Nasr saw it in simpler terms. He did not regard technology as a hindrance to growth in emerging markets, suggesting that an investment in jobs would benefit the entire ecosystem and serve as the only way to address a region’s fundamental economic and demographic problems.

Business & Sustainable Development Commission Discussion

A report by the Business & Sustainable Development Commission (whose commissioners include panelists Gavin Wilson, CEO of IFC Asset Management Company and Lise Kingo, CEO & Executive Director of the UN Global Compact) revealed that private capital and private businesses have the potential to unlock at least US$12 trillion in sustainable market opportunities by 2030. The report also claims that putting the UN’s Sustainable Development Goals (SDGs) to work could unleash monumental growth and productivity for private sector businesses.

Ms. Kingo suggested that if India (a US$1 trillion market opportunity for sustainable businesses) were to deliver on its SDG targets alone, the UN would be halfway to achieving its goals under the entire framework. Mr. Wilson cautioned that banking regulations are still impeding the flow of capital to development projects, creating a strain on the investment community but that by providing a database with consistent ESG standards for investment and utilizing blended finance, we can increase the bankability of projects. While the panelists agreed that measuring and benchmarking the impact of SDGs will be crucial for achieving these global goals, Sev Vettivetpillai, Managing Partner and Global Head of Impact Investing at The Abraaj Group, noted that private capital alone cannot achieve SDGs, but private sector partnerships with government and the society represent a meaningful pathway to progress.

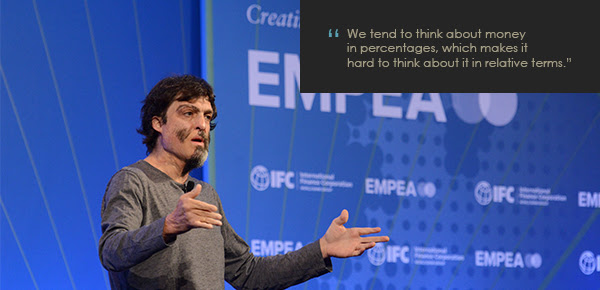

KEYNOTE ADDRESS – Dan Ariely, Head of Research for Irrational Innovations, Professor, Duke University & Founder, the Centre for Advanced Hindsight

Breakout Session: China

In the view of Yi Li, Partner at Lunar Capital, China’s economic development was unique. Though political stability is viewed as a prerequisite for economic growth, China’s leaders never imposed a one-size fits all policy, preferring a mixture of market-driven and government-led forces that protected some industries while subjecting others to competition. Ms. Li expressed optimism about the future of US-China relations, nothing that the next generation of Chinese leaders had received a Western education and look at the US as a strong ally. Rob Petty, Managing Partner & Co-Founder of Clearwater Capital Partners, also highlighted the uniqueness of China’s five-year plan, which provides a source of stability in guiding economic development policy and investorexpectations. Since it is a public document, the five-year plan acts as a powerful signal to investors, who have afairly high degree of confidence in its execution. Mr. Petty also acknowledged the critical need for the development of a Chinese credit market but noted that government policy appears to be aligned with building a robust non-bank lending market in due time. In his view, the country has also developed a respected mechanism for enforcing legal documents, which further contributes to stability.

Breakout Session: Latin America’s Rising Markets

Marco Peshiera, Managing Director and Head of Peru & Chile Buyout at the Carlyle Group, spoke about the favorable growth outlook within the Pacific Alliance thanks to favorable regulations, capital from private pension funds and low interest rates. Whereas investors used to approach investing in Latin America by concentrating their portfolios in certain countries, such as Brazil, regional flexibility will be important for protecting against economic and political risks going forward. Nick Rohatyn, CEO & CIO of The Rohatyn Group, suggested that both Mexico and Chile are facing critical moments in the political cycle in the near-future. In his view, Latin America PE investors need to be local to source the right investments but regional or global to achieve the best exits. Specifically, he pointed to opportunity in Argentina, whose reform programs are starting to create a favorable risk-reward trade off for investors even if many continue to stay away. Mr. Peshiera noted that Argentina still needs to put in place certain structural reforms, which include the creation of private pension funds and an independent central bank.

Breakout Session: Sub-Saharan Africa

According to a consumer survey cited by Susan Lund, Partner at McKinsey & Company, savings generated by incremental income from a growing African middle class is presenting significant opportunities for FinTech, as mobile banking and other services continue to open up a realm of possibilities in the areas of gender equality, poverty alleviation and education on the continent. The emergence of inter-African trade, which has historically been low, has also taken off, thereby matching African consumption with greater local production across the region. Skander Oueslati, Senior Partner at AfricInvest, observed that private sector growth in Africa will be driven by cross-border acquisition and the launch of operations in other African countries, two strategies which allow companies to diversify away from having a single base of operations on the continent. Ladell Robbins, Principal at African Capital Alliance, noted that the continent needs more money in the right places as well as younger managers with new ideas about how to implement different strategies, such as middle market investing or co-investment, to take advantage of Africa’s opportunity.

Breakout Session: MENA

Regarding fundraising for MENA-focused private equity, both Walid Cherif, Senior Managing Director of Gulf Capital, and Albert Alsina, Founder and CEO of Mediterrania Capital Partners Private Equity, noted that perceived risks in the MENA region significantly outweigh the real risks. The main challenge is to attract money from outside the region. Fundraising from family offices can be difficult, as many increasingly prefer to do deals directly, and long-term relationship development with these types of investors is critical. A longer transaction life cycle is also typical in MENA. Educating families in regards to issues such as due diligence takes a significant investment of time and requires a presence on the ground. As a result, it can take 12-18 months to build relationships with business owners, and exiting the investment can take even longer. Mr. Cherif observed that this translates into some positives. Investors have a longer period of time to observe company performance before committing capital, and partners who take a long time to negotiate terms typically honor them.

GPEC 2017 Day 2 in Review: The Future of Emerging Markets Investing

Executive Interview with Warburg Pincus’ Charles Kaye: Leadership and Pioneering the Industry

As the depth of entrepreneurial talent continues to grow in emerging markets, investors were advised to start with a great entrepreneur as opposed to a top-down sector investment thesis, which has led to successful investments in off-highway tires and telecoms in India in prior decades. Charles (Chip) Kaye, Co-Chief Executive Officer of Warburg Pincus, remarked on the importance of embracing the local opportunity, especially for large firms that have successfully invested in developed markets. Based on Warburg’s experience in China, Mr. Kaye noted that beneath a country’s headline growth figure, segments of hyper-growth can significantly outperform the average and sustain strong portfolio company growth. Furthermore, when weighing the relevance of macro factors in an investment case, Mr. Kaye believes that investors should focus less on prediction and more on assessing whether management teams and their business model can be resilient when facing periods of turbulence. Looking ahead, Mr. Kaye is optimistic about ASEAN nations, particularly Vietnam, where Warburg sees promising opportunities in the real estate, retail and hospitality sectors. Then, from a more thematic perspective, drawing on the firm’s successful investments in logistics infrastructure in China, Warburg is focused on exporting some of those lessons learned to logistics portfolio companies in India.

The New Global Financial System: Disruptive Technologies that are Redrawing the Map

In the plenary panel moderated by Andi Dervishi, Global Head of IFC’s Fintech Investment Group, panelists discussed the role of collaboration with large incumbents and the importance of regulation to the adoption of disruptive technologies in financial services. Unlike other industries where incumbents actively resist disruptors, large, connected payment networks and financial services firms recognize that disruptive innovation can bring more traffic to their networks, as noted by Iyin Aboyeji, Co-Founder and Managing Director of Flutterwave. Mr. Aboyeji’s start-up, which has rapidly gained scale and processes over US$1 billion in payments annually, partners with leading Africa banks to help them improve their merchant acquiring programs. Kathryn Petralia, Co-Founder and Chief Operating Office of Kabbage, has succeeded in the small business lending space by building a technology-driven platform to lower the cost of making small denomination loans. Panelists noted the importance of paying attention to regulators and collaborating with them to come up with smarter policies that enable the growth of FinTech companies. Mr. Dervishi noted that IFC is trying to figure out how to convert regulators from “risk focused and opportunity unaware to opportunity focused and risk aware.”

Breakout Session: Private Credit

Private credit has gained increased attention among emerging market investors. While it requires an understanding of local market nuances and significant investment in relationship building, in emerging markets, it can be rewarding. Paul Sanford, Chief Investment Officer at TriLinc Global, noted that private credit investors must work harder to build relationships and source deals, but firms appear to be well rewarded for their successful efforts. In his view, the sector remains predominantly relationship driven. He advises credit professionals to appreciate local nuances, such as how local legal jurisdictions impact what collateral packages will work in a deal. Ahmad Al-Sati, Managing Director at Albright Capital Management, expressed the view that it is possible to create credit strategies that are suitable for different types of economic cycles and periods of uncertainty. Successful private credit investors in emerging markets recognize financing gaps in the marketplace and can protect their downside with customized credit solutions if needed. Firms can get paid a premium by virtue of possessing a strong understanding of local market nuances.

Keynote Interview with TPG Growth’s Bill McGlashan: Impact Investing – Why Now?

Matthew Bishop, Senior Editor of The Economist, sat down with Bill McGlashan, Founder & Managing Partner of TPG Growth and CEO of The Rise Fund, to discuss Mr. McGlashan’s approach to impact investing given the launch of his latest US$2 billion fund which will seek to maximize both financial and social returns. According to Mr. McGlashan, what sets impact investing apart from investments with impact is the integration of key impact indicators into the underwriting, auditing and reporting process of the fund. In these situations, investors need to educate entrepreneurs on the importance of outperforming on both financial and social KPIs. The Rise Fund will target a 2x investment multiple on each deal across seven sectors where the team believes that impact can be realized and quantified. Mr. McGlashan called participants’ attention to prior IFC research showing that strong returns typically correlate with strong development impact, and poor returns typically correlate with poor social impact.

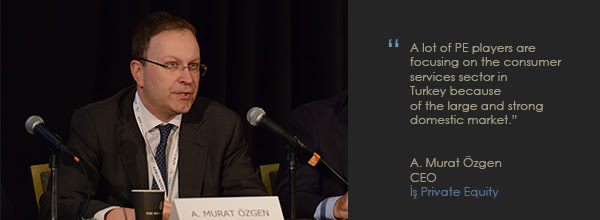

Breakout Session: Turkey

Leading investors in Turkey examined on-the-ground realities of investing in a market that could serve as the prime example of both the upside and downside of operating in emerging markets and generating outsized returns in them. The panelists discussed how recent devaluations have repressed both returns and margins; however, they cautioned that the image portrayed in the media of Turkey does not represent the full picture. Among the reasons why investors should take a closer look at this market, they highlighted reforms, such as R&D and investment incentives, established fund managers and lack of competition – the silver-lining of negative perceptions. The consumer sector, bolstered by a strong and substantial domestic market, was at the center of their case for Turkey. A. Murat Özgen, Chief Executive Officer of İş Private Equity highlighted the uptick the portfolio companies are seeing in 2017.

The panel cautioned that deals and relationships take time so fly-by investors are at a disadvantage to the local players and for similar reasons, co-investments, while welcomed, also face challenges requiring the right type of LP who can execute on them. Seymur Tari, Founder and Chief Financial Officer of Turkven Private Equity and Bariş Öney, Founder and Managing Partner of Globalturk Capital and Turkey Representative for EMPEA emphasized the growing significance of South-South (or EM-EM) investments taking place in Turkey and across other emerging markets, agreeing that it should not be overlooked or underestimated.

What’s Next for Venture Capital in Emerging Markets?

Khaled Talhouni, Managing Partner of WAMDA Capital, remarked at his interest in firms that addressed local market failures and sees strong potential for fintech in MENA, where 80-90% of payments still take the form of cash. Ritesh Banglani, Founding Partner of Stellaris Venture Partners, observed a trend in India whereby venture capital firms are becoming increasingly stage specific, although there is still a gap in later stage rounds. Adding value beyond capital is critical for differentiation. Both Mr. Costa and Mr. Talhouni drew attention to value-added services like mentoring entrepreneurs and promoting knowledge transfer across portfolio companies. Exits remain focused on trade sales, with Pekka Maki, Managing Partner at 3TS noting that channel partners and clients often make viable buyers after they have gotten to know a portfolio company’s software and core technology for several years. Firms that can offer potential acquirers immediate, regional scale are also attractive to multinationals that are struggling with market entry. While LPs have co-investment rights, the panelists noted that most deals happen without a co-investor, as small check sizes often leave little room for LPs while many lack the processes and resources to make investment decisions on a tight timeline.

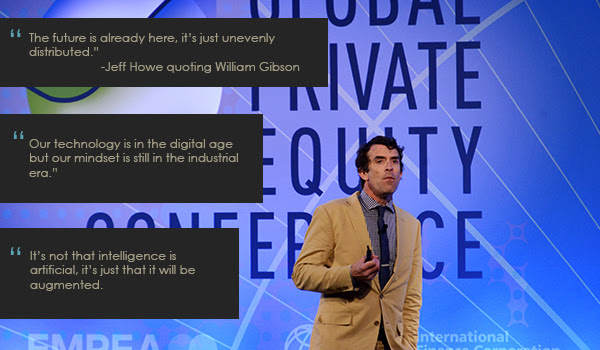

Closing Keynote with Jeff Howe, Assistant Professor, Northeastern University, Visiting Scholar, MIT Media Lab, and Author of Crowdsourcing: How the Power of the Crowd is Driving the Future of Businesses

The IFC’S 20th Annual Global Private Equity Conference in Association with EMPEA

will be held 15-16 MAY 2018

Source: EMPEA

Barış Öney

Barış Öney