Our annual private markets review showed the market scaling in 2017. The way limited partners and general partners respond to the opportunities that arise will be critical to their success.

The year just past was, once again, strong for private markets. Even as public markets rose worldwide—the S&P 500 shot up about 20 percent, as did other major indices—investors continued to show interest and confidence in private markets. Private asset managers raised a record of nearly $750 billion globally, extending a cycle that began eight years ago.

To understand the landscape, we conducted our second annual review of private markets, drawing on new analyses from our long-running research on private markets and conducting interviews with executives at some of the world’s largest and most influential general partners (GPs) and limited partners (LPs). Our latest report summarizes our findings, looking at the industry’s capital flows in 2017, including fundraising, assets under management (AUM), and capital deployment. It also reviews the implications of these dynamics for the relationship between GPs and LPs as well as discusses ideas for finding continued success.

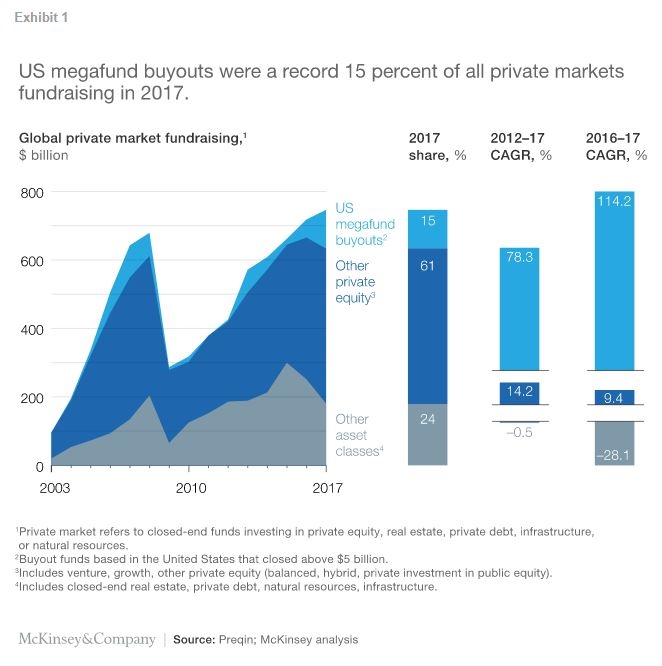

Within 2017’s tide of capital, one trend stands out: the surge of megafunds (funds of more than $5 billion), especially in the United States and particularly in buyouts (Exhibit 1). Remarkably, the industry’s record-setting 2017 growth is attributable to a single subasset class in one region. Notably too, if mega-fundraising had remained at 2016’s already lofty level, total private-market fundraising would have been down last year by 4 percent. Of course, this trend to ever-larger funds is not new. Megafunds have become more common, in part as investors have realized that scale has not imposed a performance penalty. Indeed, the largest funds have on average delivered the highest returns over the past decade, according to Cambridge Associates. What was interesting in 2017, however, was the way in which an already-powerful trend accelerated, with raises for all buyout megafunds up over 90 percent year on year. Meanwhile, fundraising in middle-market buyouts (for funds of $500 million to $1 billion) grew by 7 percent, a healthy rate after years of solid growth.

Investors’ motives for investing in private markets remain the same, more or less: the potential for alpha, and for consistency at scale. Pension funds, still the largest group of LPs, are pinched for returns. Endowments are already heavily allocated to private markets and do not appear keen to switch out. Meanwhile, sovereign wealth funds are looking to increase their exposure to private markets, increasingly using co-investments and direct investing to boost their ability to deploy capital. Fully 90 percent of LPs said recently that private equity (PE), the largest private-asset class, will outperform public markets in coming years—despite academic research that suggests such outperformance has declined on average.

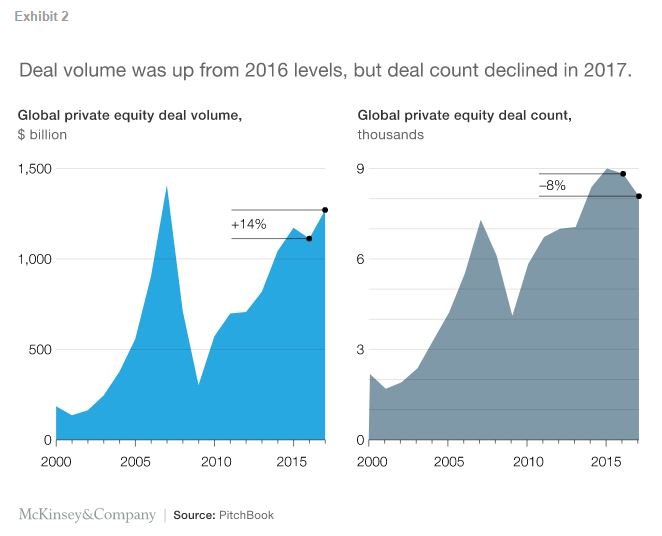

And so, capital keeps flowing in. Our research indicates that, in the past couple years, the industry’s largest firms have begun to collect a growing share of capital, perhaps starting to consolidate a fragmented industry. Yet private-asset managers did not have it all their way in 2017. The industry faced some mild headwinds investing its capital. Although the deal volume of $1.3 trillion was comparable to 2016’s activity, deal count dropped for the second year in a row, this time by 8 percent (Exhibit 2). In two related effects, the average deal size grew—from $126 million in 2016 to $157 million in 2017, a 25 percent increase—and managers accrued yet more dry powder, now estimated at a record $1.8 trillion. Private markets’ AUM, which include committed capital, dry powder, and asset appreciation, surpassed $5 trillion in 2017, up 8 percent year on year.

Why did managers hesitate to pull the trigger or struggle to find triggers to pull? One explanation is the price of acquisitions. Median PE EBITDA multiples in 2017 exceeded 10 times, a decade high and up from 9.2 times in 2016. With price tags increasingly printed on gold foil, GPs had to be smarter with their investment decisions and more strategic with their choices.

The byword of 2017 was scale. The way that LPs and GPs respond to the challenges and opportunities of scale will be critical to their success. No matter their size, LPs and GPs will need to hard-code discipline into every part of their business system. Before long, GPs might find themselves having to choose between two models: managers capable of deploying capital at scale, and specialists operating at a smaller scale. For the first group, capital will continue to pour in, but what counts as an attractive deal might shift given that asset classes like PE are not infinitely scalable—at least not with historical levels of performance. For the second group, a strategic decision is at hand: get bigger, or stay the course. Both options can be successful if firms recognize their differentiation and execute their strategies with the necessary rigor.

Kaynak: McKinsey.com

Barış Öney Barış Öney'in Kişisel Web Sitesidir.

Barış Öney Barış Öney'in Kişisel Web Sitesidir.