2016 EM Private Capital Activity Dips Year-Over-Year Despite Upswings in Select Markets, Strategies and Sectors

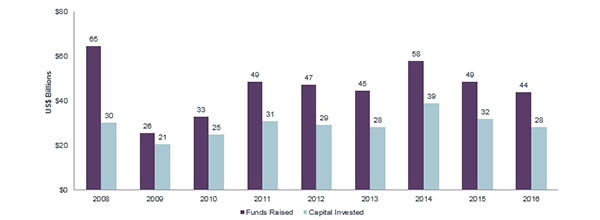

Emerging markets private capital fundraising and investment—inclusive of private equity, private infrastructure and real assets and private credit—declined 9.4% and 12% year-over-year, respectively, despite notable increases in activity across key markets, strategies and sectors.

Emerging markets private capital fundraising and investment—inclusive of private equity, private infrastructure and real assets and private credit—declined 9.4% and 12% year-over-year, respectively, despite notable increases in activity across key markets, strategies and sectors.

EM Fundraising and Investment

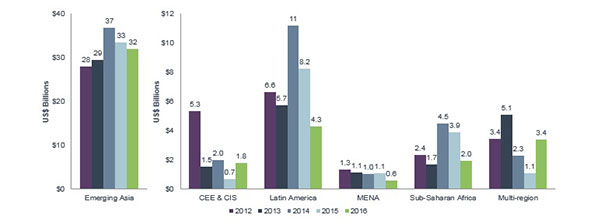

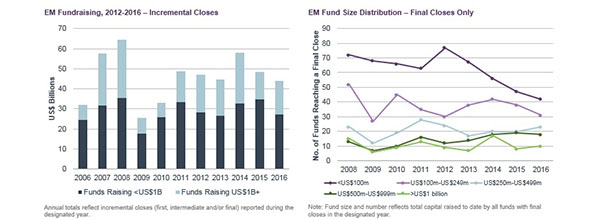

Fund managers raised a combined total of US$44 billion for emerging economies, down from US$49 billion in 2015. While Latin America and Sub-Saharan Africa experienced the largest declines in capital raised, fundraising for CEE and CIS jumped from US$715 million in 2015 to US$1.8 billion in 2016, due in large part to an upswing in commitments to Turkey-focused vehicles. Fundraising for multi-regional funds increased from US$1.1 billion in 2015 to US$3.4 billion this past year, the highest total since 2013. However, fewer large funds raising US$1 billion or more in 2016 left the year-end total behind the post-financial crisis high of US$58 billion raised in 2014. Strategy diversification was on the rise for EM fundraising as private credit and venture capital both reached record highs in 2016.

Investment activity in emerging markets fell slightly in 2016. Fund managers deployed US$28 billion in disclosed transactions in 2016 and completed 1,589 deals across all stages, representing 12% and 8.7% declines, respectively. Waning venture capital (“VC”) and growth private equity (“PE”) investment activity in Emerging Asia this year had a significant impact on EM investment totals, nearly equaling the full difference in disclosed capital invested from 2015 to 2016. The region’s slowdown in capital deployment was a counterweight to increases in other EM regions, with year-on-year increases in Latin America (49%), Sub-Saharan Africa (10%) and MENA (81%).

EM Fundraising by Region

Key Takeaways

1) Private Capital Activity Increased in Select Key Markets Beyond the BRICs

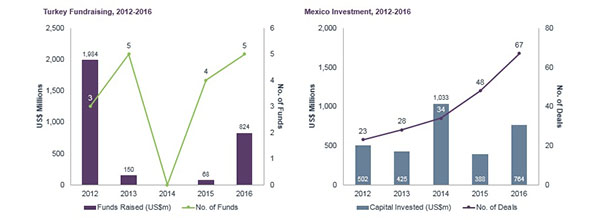

Fundraising for Turkey-focused vehicles was the highest since 2012, while disclosed capital invested in Mexico doubled and deals completed increased 40%.

Turkey – Fund managers raised US$824 million for Turkey-focused private capital funds in 2016, the highest total recorded for the country since 2012, when fund managers raised US$2.0 billion. The largest funds raised for the market in 2016 were Abraaj Turkey Fund I, Mediterra Capital Partners II and Taxim Capital Partners I. Despite current economic conditions, strong fundraising for the market suggests many investors remain attracted to its long-term prospects.

Mexico – As EMPEA documented in its 2016 report Private Equity in Mexico, perhaps no country better exemplifies the power of local capital in driving the growth of private equity than Mexico. After fund managers raised a combined US$5.7 billion for Mexico-dedicated private capital funds in 2014 and 2015—including US$3.9 billion for local CKD funds—disclosed capital invested and deals completed in the country significantly increased by 97% and 40%, respectively, in 2016. Fundraising reached US$665 million in 2016, a 73% decline from 2015, but not unexpected following two robust fundraising years.

Nigeria – Despite ongoing dislocations in local financial markets, fund managers deployed US$354 million in Nigeria this year, up slightly from US$350 million in 2015. The notable size of several transactions for the country, as well as the region, reported in the second half of the year signals continued interest in Nigeria and Sub-Saharan Africa. The largest transactions recorded for 2016 include Helios Investment Partners’ US$116 million investment in Oando Gas and Power, along with a US$70 million investment in snack food maker Beloxxi Industries by African Capital Alliance and 8 Miles.

Fund managers raised US$8.4 billion for Sub-Saharan Africa from 2014 to 2015, before many economies in the region entered a difficult economic period brought on by lower commodity prices and currency volatility. However, the changing environment may provide opportunities for fund managers as they look to put their record fundraising to work in growing and resilient sectors , such as renewable power, including distributed generation. Nigeria was emblematic of activity across many Sub-Saharan African markets in 2016, with regional fundraising declining 80% following record-setting years, while disclosed capital invested in the region increased 10%, year-on-year.

2) Private Capital Fund Managers Raised a Record Amount of Capital

Private credit fund managers raised US$5.9 billion in 2016, the highest total recorded by EMPEA since it began tracking fundraising in 2006. The 2016 private credit fundraising surge follows the US$5.6 billion private credit fund managers raised in 2015, which was itself a record. Many of the largest vehicles raised were Asia-focused distressed debt and special situations funds, including the US$1.12 billion Farallon Asia Special Situations III and China-focused DCL Investments’ US$549 million maiden fund.

Investor interest in distressed debt and special situations opportunities in China and India was particularly strong—Emerging Asia accounted for 46% of the 2016 EM private credit fundraising total—but private credit strategies are proving increasingly popular across all EM regions. The largest fund close in MENA in 2016 was for Gulf Capital’s US$251 million GC Credit Opportunities Fund II.

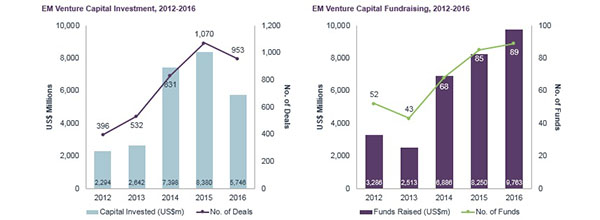

3) Venture Capital Deals Slowed, While Fundraising Continued to New Heights

Venture capital investment activity declined in 2016 to US$5.7 billion from US$8.4 billion in 2015. A slowdown in Emerging Asia’s investment activity left a noticeable impact on the overall EM investment aggregates given the rising significance of VC in these economies in recent years.

Annual VC deal count decreased in emerging markets for the first time since 2009, and it was the slowdown in VC investment activity in Emerging Asia, especially in the early-stage space, that explains most of the decline. This regional trend mirrors similar VC slowdowns in the United States and Western Europe. While the global data indicates a pattern of VC fund managers pulling back after strong investment momentum over the last several years, the deceleration did not affect all EM regions. In Sub-Saharan Africa and Latin America, VC deal count increased 43% and 38%, respectively, from 2015, albeit from a low base. In contrast to the slowing in investment activity, capital raised for EM VC funds reached US$9.8 billion in 2016, the highest level recorded by EMPEA, up from $8.3 billion in 2015. This record fundraising total suggests the current slowdown in investment activity does not indicate a retrenchment from the venture space on the part of emerging markets investors.

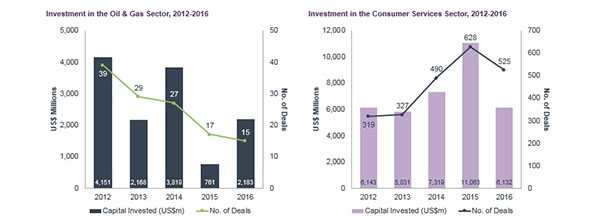

4) Oil & Gas Investment Recovered Across EM Regions

After declining last year, capital invested in the oil & gas sector recovered in 2016, with large transactions in MENA, Latin America and Sub-Saharan Africa.

Capital deployed by private capital fund managers in the sector reached US$2.2 billion in 2016, up from US$761 million in 2015. While many investors have pursued distressed opportunities in the oil & gas industry in recent years, the largest disclosed EM oil & gas investments recorded in 2016 were greenfield exploration & production platforms: The Carlyle Group and Warburg Pincus’s respective US$500 million equity commitments to Mazarine Energy and Apex International Energy. They were also among the largest transactions recorded across all sectors. Moreover, while oil & gas prices have only begun to recover in recent months, this rebound bodes well for the health of many emerging markets, should it continue, due to the sector’s central role in many of these economies.

5) Large Funds’ Weight in EM Fundraising Persisted

The effect of capital concentration in large funds for fundraising totals remained pronounced throughout the year. EM funds raising US$1 billion or more in 2016 accounted for 38%, or US$17 billion, of the annual total; yet, fewer of them this year compared to years prior weighed down fundraising totals.

In each of the three years since 2006 when total capital raised for EM private capital has exceeded US$50 billion (2007, 2008 and 2014), these large funds raised at least US$25 billion of the EM total. In 2016, only 10 funds raised US$1 billion or more. Nevertheless, further analysis suggests fund size distribution is narrowing and the large fund effect is increasing as fewer smaller funds have reached final closes in recent years. For instance, only 73 funds of US$250 million or less reached a final close in 2016, compared to a high of 124 in 2008.

Source: EMPEA

Barış Öney Barış Öney'in Kişisel Web Sitesidir.

Barış Öney Barış Öney'in Kişisel Web Sitesidir.