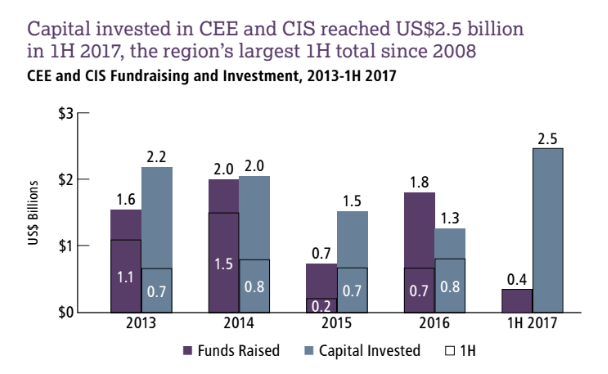

During the first half of 2017, fund managers invested US$2.5 billion in CEE and CIS, representing the region’s largest first-half investment total since 2008. Much of the capital invested in the region so far this year comes from pan-European managers such as Cinven and Permira, which both participated in the US$2 billion investment round in Allegro. Overall, 38% of managers investing in CEE and CIS in 1H 2017 have pan-European or multi-regional remits, an increase from 31% of managers in 2016 and just 27% in 2015. Conversely, Central European fund managers drove exit activity in the region. Managers focused on the region completed IPOs on public exchanges in Turkey, Poland and Romania since December, as well as a listing by Mid Europa Partners of Hungarian logistics platform Waberer’s in Budapest in early Q3 2017. Of these countries, only Poland had previously recorded a PE-backed IPO since EMPEA began reporting exit statistics in 2008. This uptick in public market exits suggests a growing maturity of both the managers and markets within CEE and CIS.

Click for the Full Report: CEE and CIS Data Insight (1H 2017)

Source: Empea.org

Barış Öney

Barış Öney